November 2011

Healthy Fall Market Continues in November

Toronto, December 9, 2011

Greater Toronto REALTORS® reported 7,092 residential transactions through the TorontoMLS® system in November – up 11 per cent in comparison to November 2010. At the same time, the number of new listings was up by 14 per cent in comparison to last year.

“We have seen strong annual sales growth through the 2011 fall market. The increase in transactions has been broad-based, with strong growth across low-rise and high-rise home types throughout the Greater Toronto Area,” said Toronto Real Estate Board (TREB) President Richard Silver. “The market has also become better supplied, with

annual new listings growth outstripping that of sales. As this trend continues into 2012, we will see more balanced market conditions.”

The average price for November transactions was $480,421, representing an increase of almost 10 per cent in comparison to $437,494 in November 2010. “Despite strong price growth this year, the housing market remains affordable in the GTA,” said Jason Mercer, TREB’s Senior Manager of Market Analysis. “The correct method of assessing affordability is to consider the share of the average household’s income that is dedicated to mortgage principal and interest, property taxes and utilities. Currently, this share remains in line with generally accepted lending guidelines. Given this positive affordability picture, average price growth is forecast to continue in 2012, albeit at a more moderate pace.”

Jonathan’s Opinion

Prices have increased by 9.8% this same period last year. Notice, however, that listings have also increased. This shows that there are more people selling this year than last year. However the sales have also increased year over year, which means that although there are more people selling this year, there is still a lot of demand, and more people buying. As long as this is the case, prices will continue to rise. However, prices will not rise as fast and as sharply if listings (houses available on the market) continue increasing.

This is one sign that the market may be reaching equilibrium (same amount of buyers as sellers). The Bank of Canada has announced that interest rates will remain low for at least of all 2012. As long as interest rates stay low, it will take a much longer time to reach equilibrium because there will always be more buyers than sellers. To reach price stability, we must reach equilibrium between supply and demand (sellers and buyers).

Tuesday, December 13, 2011

Tuesday, November 8, 2011

October Market Watch Report

October 2011

Pace of Home Sales Remains Brisk in October

Toronto, November 7, 2011

Greater Toronto REALTORS® reported 7,642 home sales through the TorontoMLS® in October 2011. This represented an increase of 17.5 per cent compared to the 6,504 transactions reported in October 2010.

Monthly sales data follow a recurring seasonal trend that should be removed before comparing monthly results within the same year. After adjusting for seasonality, the annualized rate of sales for October was 97,100, which was above the average of 90,700 for the first three quarters of 2011.

“The pace of October resale home transactions remained brisk in the GTA. This bodes well for a strong finish to 2011,” said Toronto Real Estate Board President Richard Silver. “Home buyers who found it difficult to make a deal in the spring and summer due to a shortage of listings have benefitted from increased supply in the fall.” The average selling price through the TorontoMLS® in October was $478,137 – up eight per cent compared to October 2010.

“Sellers’ market conditions remain in place in many parts of the GTA. The result has been above-average annual rates of price growth for most home types,” said Jason Mercer, the Toronto Real Estate Board’s Senior Manager of Market Analysis. “Thanks to low interest rates, strong price growth has not substantially changed the positive affordability picture in the City of Toronto and surrounding regions.”

Jonathan’s Opinion

Prices have increased by 8% this same period last year. Notice, however, that listings have also increased. This shows that there are more people selling this year than last year. However the sales have also increased year over year, which means that although there are more people selling this year, there is still a lot of demand, and more people buying. As long as this is the case, prices will continue to rise.

However, prices will not rise as fast and as sharply if listings (houses available on the market) continue increasing. This is one sign that the market may be reaching equilibrium (same amount of buyers as sellers). As long as interest rates stay low, however, it will take a much longer time to reach equilibrium because there will always be more buyers than sellers.

To reach price stability, we must reach equilibrium between supply and demand (sellers and buyers).

Monday, October 24, 2011

September Market Watch Report

September Rounds Out a Strong Third Quarter

Toronto, October 20, 2011

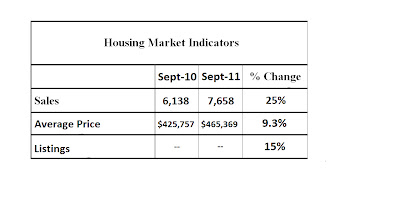

– Greater Toronto REALTORS® reported 7,658 transactions through the TorontoMLS® system in September – a 25 per cent increase over September 2010. Sales during the first three quarters of 2011 amounted to 70,588, representing a 2.6 per cent increase compared to the first nine months of 2010.

“We have experienced strong growth in sales so far this year, with a much more active summer compared to 2010. However, while sales have been strong, we have continued to experience a shortage of listings, resulting in more competition between home buyers,” said Toronto Real Estate Board President Richard silver. “Over the past few months, the listing situation has started to improve, so we expect home buyers will have more homes to choose from in the months ahead.”

With annual growth in sales (+25 per cent) outstripping annual growth in new listings (+15 per cent) in September, market conditions became tighter and the average selling price continued to grow by close to 10 per cent on a year-over-year basis.

“Strong price growth through the first nine months of the year was mitigated to a great degree by low interest rates and rising incomes,” said the Toronto Real Estate Board’s Senior Manager of Market Analysis Jason Mercer. “As buyers continue to take advantage of the affordable home ownership options in the GTA, we remain on pace for the second best year for sales under the current TREB market area.”

Jonathan’s Opinion

We have another month of higher prices.

This story will go on and on if interest rates do not increase. However, it is simple to just say that rates have to go up, and there are several reasons that the bank of Canada is keeping them low. The principle reason is because of the growing concern in the U.S. If Canada were to raise the interest rate, our dollar would be seen as a more attractive investment over the U.S. dollar (the reason is because our dollar would be earning more interest in our banks), and more investors would flock to our banks as somewhere to park their money. This would ultimately lead to our dollar increasing in value.

While most people would say that that is great, it’s not really…if our dollar increases relative to the U.S dollar, then our products would be more expensive for them to buy. This is would ultimately decrease our exports to the U.S also. This would definitely not be a good thing because over 70% of all our exports are to the U.S.

As you can see, the situation is much more complicated than one would assume, and it is interesting to see how it will be resolved. In a nut shell, Canada has to start building ties with other countries and start exporting to them (i.e. China, and India), and stop being so dependent on the U.S.

Toronto, October 20, 2011

– Greater Toronto REALTORS® reported 7,658 transactions through the TorontoMLS® system in September – a 25 per cent increase over September 2010. Sales during the first three quarters of 2011 amounted to 70,588, representing a 2.6 per cent increase compared to the first nine months of 2010.

“We have experienced strong growth in sales so far this year, with a much more active summer compared to 2010. However, while sales have been strong, we have continued to experience a shortage of listings, resulting in more competition between home buyers,” said Toronto Real Estate Board President Richard silver. “Over the past few months, the listing situation has started to improve, so we expect home buyers will have more homes to choose from in the months ahead.”

With annual growth in sales (+25 per cent) outstripping annual growth in new listings (+15 per cent) in September, market conditions became tighter and the average selling price continued to grow by close to 10 per cent on a year-over-year basis.

“Strong price growth through the first nine months of the year was mitigated to a great degree by low interest rates and rising incomes,” said the Toronto Real Estate Board’s Senior Manager of Market Analysis Jason Mercer. “As buyers continue to take advantage of the affordable home ownership options in the GTA, we remain on pace for the second best year for sales under the current TREB market area.”

Jonathan’s Opinion

We have another month of higher prices.

This story will go on and on if interest rates do not increase. However, it is simple to just say that rates have to go up, and there are several reasons that the bank of Canada is keeping them low. The principle reason is because of the growing concern in the U.S. If Canada were to raise the interest rate, our dollar would be seen as a more attractive investment over the U.S. dollar (the reason is because our dollar would be earning more interest in our banks), and more investors would flock to our banks as somewhere to park their money. This would ultimately lead to our dollar increasing in value.

While most people would say that that is great, it’s not really…if our dollar increases relative to the U.S dollar, then our products would be more expensive for them to buy. This is would ultimately decrease our exports to the U.S also. This would definitely not be a good thing because over 70% of all our exports are to the U.S.

As you can see, the situation is much more complicated than one would assume, and it is interesting to see how it will be resolved. In a nut shell, Canada has to start building ties with other countries and start exporting to them (i.e. China, and India), and stop being so dependent on the U.S.

Wednesday, July 6, 2011

June Market Watch Report

Toronto MLS Sales and Average Price up in June

TORONTO – July 6, 2011

Greater Toronto REALTORS® reported 10,230 home sales through the Toronto MLS® system in June 2011 – up 21 per cent compared to June 2010. This number represented the third best June result on record behind 2007 and 2009. The number of transactions during the first six months of 2011 amounted to 48,189 – down by 4.5 per cent compared to the first half of 2010.

“The strong June result capped off an interesting first half of 2011,” said Toronto Real Estate Board President Richard Silver. “The pace of sales was a bit sluggish at the beginning of the year, but rebounded in May and June. Because of the positive affordability picture, home buyers remained confident in their ability to purchase and pay for a home over the long term.”

The average price for June transactions was $476,371 – a 9.5 per cent increase over June 2010. Through the first six months of the year, the average selling price was $467,169 – almost an eight per cent increase compared to the same period in 2010.

“While sales have been strong, we would be on track for a record number of transactions in 2011 if not for the decline in listings so far this year,” said Jason Mercer, the Toronto Real Estate Board’s Senior Manager of Market Analysis. “Tight supply meant more competition between home buyers and an accelerating annual rate of price growth in the second quarter.”

“Home owners will likely react to the stronger price growth by listing their homes in greater numbers. A better supplied market would result in more moderate price increases,” continued Mercer.

Jonathan’s Opinion

We have another month of higher prices.

This story will go on and on if interest rates do not increase. At the beginning of the year the Bank of Canada announced that rates would undoubtedly increase in March, which never happened, then July, which never happened, and now they are saying that the rates will remain unchanged until the beginning of 2012.

Yes the economy is still recovering, and an increase in interest rates could hinder this recovery, but I can guarantee you that if prices keep increasing as they do, along with Canadian debt loads, the future of the economy will not be so bright. At one point or another, interest rates have to go up, in order to slow down inflation. The BOC should not wait until there is too much inflation…they should start raising rates now. It is better to feel some temporary pain when debt loads are lower, rather than feeling it later, when debt loads are higher and prices on everything (not just real estate) are inflated, don’t you think?? Affordability can become a major issue.

TORONTO – July 6, 2011

Greater Toronto REALTORS® reported 10,230 home sales through the Toronto MLS® system in June 2011 – up 21 per cent compared to June 2010. This number represented the third best June result on record behind 2007 and 2009. The number of transactions during the first six months of 2011 amounted to 48,189 – down by 4.5 per cent compared to the first half of 2010.

“The strong June result capped off an interesting first half of 2011,” said Toronto Real Estate Board President Richard Silver. “The pace of sales was a bit sluggish at the beginning of the year, but rebounded in May and June. Because of the positive affordability picture, home buyers remained confident in their ability to purchase and pay for a home over the long term.”

The average price for June transactions was $476,371 – a 9.5 per cent increase over June 2010. Through the first six months of the year, the average selling price was $467,169 – almost an eight per cent increase compared to the same period in 2010.

“While sales have been strong, we would be on track for a record number of transactions in 2011 if not for the decline in listings so far this year,” said Jason Mercer, the Toronto Real Estate Board’s Senior Manager of Market Analysis. “Tight supply meant more competition between home buyers and an accelerating annual rate of price growth in the second quarter.”

“Home owners will likely react to the stronger price growth by listing their homes in greater numbers. A better supplied market would result in more moderate price increases,” continued Mercer.

Jonathan’s Opinion

We have another month of higher prices.

This story will go on and on if interest rates do not increase. At the beginning of the year the Bank of Canada announced that rates would undoubtedly increase in March, which never happened, then July, which never happened, and now they are saying that the rates will remain unchanged until the beginning of 2012.

Yes the economy is still recovering, and an increase in interest rates could hinder this recovery, but I can guarantee you that if prices keep increasing as they do, along with Canadian debt loads, the future of the economy will not be so bright. At one point or another, interest rates have to go up, in order to slow down inflation. The BOC should not wait until there is too much inflation…they should start raising rates now. It is better to feel some temporary pain when debt loads are lower, rather than feeling it later, when debt loads are higher and prices on everything (not just real estate) are inflated, don’t you think?? Affordability can become a major issue.

Thursday, June 16, 2011

Bank of Canada to Keep Rates Steady Until 2012

Good article describing the BOC's intentions on interest rates:

http://www.canadianrealestatemagazine.ca/news/106856/details.aspx

http://www.canadianrealestatemagazine.ca/news/106856/details.aspx

Tuesday, May 31, 2011

Bank of Canada Announces No Change in Interest Rates

Excellent article describing why the Bank of Canada has decided to keep the interest rates at historically low levels.

Click below:

http://www.thestar.com/business/article/999871--global-economy-too-fragile-for-rate-hike-says-central-bank?bn=1

Click below:

http://www.thestar.com/business/article/999871--global-economy-too-fragile-for-rate-hike-says-central-bank?bn=1

Tuesday, May 24, 2011

CREA's April report signifies downward trend for 2011, 2012: TD Economist

Excellent article on the current state, and future trend of the Canadian Real Estate Market.

Very much in line with my beliefs as well.

Cick the link below:

http://www.canadianrealestatemagazine.ca/news/106723/details.aspx

Very much in line with my beliefs as well.

Cick the link below:

http://www.canadianrealestatemagazine.ca/news/106723/details.aspx

Thursday, May 12, 2011

With rising interest rates, should you lock in or stay variable??

Read the following article for a better understanding of what works for you!!

http://www.canadianrealestatemagazine.ca/news/106662/details.aspx?utm_medium=email&utm_source=MyNewsletterBuilder&utm_content=187552693&utm_campaign=Fixed+or+variable+old+debate+new+landscape+1410854697&utm_term=Read+more

http://www.canadianrealestatemagazine.ca/news/106662/details.aspx?utm_medium=email&utm_source=MyNewsletterBuilder&utm_content=187552693&utm_campaign=Fixed+or+variable+old+debate+new+landscape+1410854697&utm_term=Read+more

Wednesday, May 11, 2011

Vancouver Housing Market Bubble

Click below to view a quick and very interesting article.

Will Toronto have the same fate?? It is too early to tell.

http://www.canadianrealestatemagazine.ca/News/106696/details.aspx?utm_medium=email&utm_source=MyNewsletterBuilder&utm_content=187552693&utm_campaign=Housing+bubble+ready+to+pop+in+Vancouver+1410862021&utm_term=Read+more

Will Toronto have the same fate?? It is too early to tell.

http://www.canadianrealestatemagazine.ca/News/106696/details.aspx?utm_medium=email&utm_source=MyNewsletterBuilder&utm_content=187552693&utm_campaign=Housing+bubble+ready+to+pop+in+Vancouver+1410862021&utm_term=Read+more

Monday, May 9, 2011

April Market Watch Report

April 2011

Tight Market Results in Strong Price Growth in April

TORONTO – May 5, 2011

Greater Toronto REALTORS® reported 9,041 existing home sales through the TorontoMLS® system in April 2011. This result was down 17 per cent compared April 2010 when sales spiked to a new record of 10,898. While off last year’s record result, April 2011 sales were in line with the average April sales level reported over the previous five years.

“Existing home sales have been strong from a historic perspective through the first four months of 2011. Expect the pace of sales to remain robust through the spring, as the economy expandsand home bu yers continue to benefit from affordable home ownership opportunities,” said Toronto Real Estate Board (TREB) President Bill Johnston.

Market conditions tightened markedly over the last year. April 2011 sales accounted for 62 percent of new listings during the month – up substantially from 53 per cent in April 2010. Tighter conditions resulted in the average April selling price growing by nine percent annually to $477,407.

“The number of listings has been below expectations so far this year. Increased competition between home buyers has led to an accelerating annual rate of price growth,” said Jason Mercer, TREB’s Senior Manager of Market Analysis. “The strong price growth experienced in April should result in more listings and more balanced market conditions.”

Jonathan’s Opinion

Unsurprisingly, we have another month of lower sales and higher prices. This is once again attributable to the fact that there is very little inventory (listings/supply) on the market, and still many Buyers/Demand, due to very low interest rates. However, when looking at these price increases it is important to understand that the numbers may be a little skewed.

The reason is because the average price figures include the sale price of ALL houses in Toronto, from the smallest least expensive, to the largest multi-million dollar mansion. Therefore, for example, if there have been ten 5 million dollar properties sold last month, the average price as a whole will be higher.

Nevertheless, prices are higher but will begin to level off as interest rates begin increasing (and they will). Listings and sales will increase (as they always do in the spring), and as supply and demand converge, prices will remain stable (we will not see double digit percent increases as we have this last year and a half).

Houses will still hold their value, but they may take a little longer to sell!

Tight Market Results in Strong Price Growth in April

TORONTO – May 5, 2011

Greater Toronto REALTORS® reported 9,041 existing home sales through the TorontoMLS® system in April 2011. This result was down 17 per cent compared April 2010 when sales spiked to a new record of 10,898. While off last year’s record result, April 2011 sales were in line with the average April sales level reported over the previous five years.

“Existing home sales have been strong from a historic perspective through the first four months of 2011. Expect the pace of sales to remain robust through the spring, as the economy expandsand home bu yers continue to benefit from affordable home ownership opportunities,” said Toronto Real Estate Board (TREB) President Bill Johnston.

Market conditions tightened markedly over the last year. April 2011 sales accounted for 62 percent of new listings during the month – up substantially from 53 per cent in April 2010. Tighter conditions resulted in the average April selling price growing by nine percent annually to $477,407.

“The number of listings has been below expectations so far this year. Increased competition between home buyers has led to an accelerating annual rate of price growth,” said Jason Mercer, TREB’s Senior Manager of Market Analysis. “The strong price growth experienced in April should result in more listings and more balanced market conditions.”

Jonathan’s Opinion

Unsurprisingly, we have another month of lower sales and higher prices. This is once again attributable to the fact that there is very little inventory (listings/supply) on the market, and still many Buyers/Demand, due to very low interest rates. However, when looking at these price increases it is important to understand that the numbers may be a little skewed.

The reason is because the average price figures include the sale price of ALL houses in Toronto, from the smallest least expensive, to the largest multi-million dollar mansion. Therefore, for example, if there have been ten 5 million dollar properties sold last month, the average price as a whole will be higher.

Nevertheless, prices are higher but will begin to level off as interest rates begin increasing (and they will). Listings and sales will increase (as they always do in the spring), and as supply and demand converge, prices will remain stable (we will not see double digit percent increases as we have this last year and a half).

Houses will still hold their value, but they may take a little longer to sell!

Monday, May 2, 2011

True or False?? and "Bully Offers"

If an offer on a property is for full asking price, the Seller must accept it! TRUE OR FALSE??

The answer is FALSE!

A Buyer can offer any price they feel, and the Seller is not obligated to accept it, even if it is well over the asking price.

For some reason there is a misconception that a Seller must accept an offer on their property if it is full price.

This is where "BULLY OFFERS" are most common. I'll explain:

Real Life Example:

This happened to me several weeks ago on a house that I had listed for sale. The house was listed for $499,900 (which was below market value), and, as per the Sellers written instructions, I restricted the presentations of all offers until a further date. This is a strategy that normally generates multiple offers (bidding wars).

After the property was listed, I had about 50 showings in 3 days, and an Realtor called me and told me that his client wanted to put an offer in. They knew that offers were being restricted until a further date, but insisted to fax me an offer before that date anyways--this is a BULLY OFFER...(I have a legal duty to present that offer to my clients).

The offer was very good...the price $15,000 over the asking price, and the offer was firm (no conditions). When presenting this offer to my clients, I explained to them that I would not accept this offer regardless of its attractiveness, because I was confident that the day of offer presentations, we would get multiple offers, and the house would be sold for even higher than $15,000 over asking.

My clients respected my advise, and decided to wait until the offer presentation date. At that time we received 4 offers in total, and the house ended up selling for $35,000 over the asking price, with no conditions. My clients were very happy, and realized that by waiting they made the right decision.

In conclusion, all Sellers must remember that they DO NOT have an obligation to accept any offer, regardless of the price.

By decling the BULLY OFFER, my client managed to earn an extra $20,000!!!

The answer is FALSE!

A Buyer can offer any price they feel, and the Seller is not obligated to accept it, even if it is well over the asking price.

For some reason there is a misconception that a Seller must accept an offer on their property if it is full price.

This is where "BULLY OFFERS" are most common. I'll explain:

Real Life Example:

This happened to me several weeks ago on a house that I had listed for sale. The house was listed for $499,900 (which was below market value), and, as per the Sellers written instructions, I restricted the presentations of all offers until a further date. This is a strategy that normally generates multiple offers (bidding wars).

After the property was listed, I had about 50 showings in 3 days, and an Realtor called me and told me that his client wanted to put an offer in. They knew that offers were being restricted until a further date, but insisted to fax me an offer before that date anyways--this is a BULLY OFFER...(I have a legal duty to present that offer to my clients).

The offer was very good...the price $15,000 over the asking price, and the offer was firm (no conditions). When presenting this offer to my clients, I explained to them that I would not accept this offer regardless of its attractiveness, because I was confident that the day of offer presentations, we would get multiple offers, and the house would be sold for even higher than $15,000 over asking.

My clients respected my advise, and decided to wait until the offer presentation date. At that time we received 4 offers in total, and the house ended up selling for $35,000 over the asking price, with no conditions. My clients were very happy, and realized that by waiting they made the right decision.

In conclusion, all Sellers must remember that they DO NOT have an obligation to accept any offer, regardless of the price.

By decling the BULLY OFFER, my client managed to earn an extra $20,000!!!

Friday, April 8, 2011

March Market Watch Report

March 2011

Second Best March on Record

TORONTO – April 5, 2011

Greater Toronto REALTORS® reported 9,262 transactions through the TorontoMLS®

system in March 2011, representing the second best March result on record. The number of

transactions was 11 per cent lower than the record result reported in March 2010.

“The strong home sales reported in March and throughout the first quarter of 2011 have

been based on a solid affordability picture and improving economic conditions in the GTA

and country-wide,” said Toronto Real Estate Board (TREB) President Bill Johnston.

The average selling price for March 2011 was up five percent year-over-year to $456,147. The strongest average annual price growth was reported for condominium apartments and semi-detached houses, at approximately seven per cent for both home types.

“Market conditions were tighter in March compared to last year. With more competition

between buyers, we have seen a strong but sustainable rate of price growth,” said Jason

Mercer, TREB’s Senior Manager of Market Analysis.

Jonathan’s Opinion

The month of March was very similar to February in that both sales and listings are still down. As the spring market begins, I anticipate that both these numbers will change. I believe the amount of listings will increase in the following months, which will lead to an increase in sales. There are still many Buyers looking for homes, and as the amount of Buyers and Sellers begin balancing out, the average price of a home will remain pretty steady.

Although sales are down, the average price is up. This is a strong indicator of a “topping”

market. Please understand that I do not mean that the market will collapse after March or

April, but I believe it will cool down. Listings and sales will increase (as they always do in the spring), but as supply and demand converge, prices will remain stable (we will not see double digit percent increases as we have this last year and a half).

Houses will still hold their value, but they may take a little longer to sell!

Second Best March on Record

TORONTO – April 5, 2011

Greater Toronto REALTORS® reported 9,262 transactions through the TorontoMLS®

system in March 2011, representing the second best March result on record. The number of

transactions was 11 per cent lower than the record result reported in March 2010.

“The strong home sales reported in March and throughout the first quarter of 2011 have

been based on a solid affordability picture and improving economic conditions in the GTA

and country-wide,” said Toronto Real Estate Board (TREB) President Bill Johnston.

The average selling price for March 2011 was up five percent year-over-year to $456,147. The strongest average annual price growth was reported for condominium apartments and semi-detached houses, at approximately seven per cent for both home types.

“Market conditions were tighter in March compared to last year. With more competition

between buyers, we have seen a strong but sustainable rate of price growth,” said Jason

Mercer, TREB’s Senior Manager of Market Analysis.

Jonathan’s Opinion

The month of March was very similar to February in that both sales and listings are still down. As the spring market begins, I anticipate that both these numbers will change. I believe the amount of listings will increase in the following months, which will lead to an increase in sales. There are still many Buyers looking for homes, and as the amount of Buyers and Sellers begin balancing out, the average price of a home will remain pretty steady.

Although sales are down, the average price is up. This is a strong indicator of a “topping”

market. Please understand that I do not mean that the market will collapse after March or

April, but I believe it will cool down. Listings and sales will increase (as they always do in the spring), but as supply and demand converge, prices will remain stable (we will not see double digit percent increases as we have this last year and a half).

Houses will still hold their value, but they may take a little longer to sell!

Monday, March 7, 2011

February Market Watch Report

Average Selling Price Up in February

TORONTO – March 3, 2011

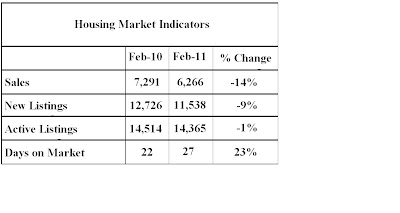

Greater Toronto REALTORS® reported 6,266 transactions through the Toronto MLS® system in February 2011. This result was 14 per cent lower than the record sales reported in February 2010. While not representing a record, February 2011 sales were 50 per cent higher than the number reported in February 2009 during the recession and slightly higher than the average February sales over the previous ten years. “Continued improvement in the GTA economy, including growth in jobs and incomes and a declining unemployment rate, has kept the demand for ownership housing strong,” said Toronto Real Estate Board (TREB) President Bill Johnston.

The average selling price for February 2011 transactions was $454,423, which was more than five per cent higher than the average selling price reported in February 2010.

“Market conditions remain quite tight in the GTA. There is enough competition between

home buyers to promote continued price growth,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

Jonathan’s Opinion

If you recall in my January Market Watch Report, I stated the main reason that sales are down is not because the market is slowing down, but because there are fewer listings. This is still the case…there are not a lot of properties on the market to choose from. I also mentioned that ever since the announcement of the new mortgage rules, the amount of demand has increased because buyers want to purchase a home before these rules come into effect.

This trend is still alive and will continue until the end of March. Furthermore, take a look at sales vs price. Although sales are down, the average price is up. This is a strong indicator of a “topping” market. Please understand that I do not mean that the market will collapse after March or April, but I believe it will cool down. Listings will increase (as they always do in the spring), sales will fall as fewer buyers will rush in to purchase a home, and as a consequence, prices will remain stable (we will not see double digit percent increases as we have this last year and a half).

Therefore, if you want to sell your house fast, and for top dollar, you still have some time!!

TORONTO – March 3, 2011

Greater Toronto REALTORS® reported 6,266 transactions through the Toronto MLS® system in February 2011. This result was 14 per cent lower than the record sales reported in February 2010. While not representing a record, February 2011 sales were 50 per cent higher than the number reported in February 2009 during the recession and slightly higher than the average February sales over the previous ten years. “Continued improvement in the GTA economy, including growth in jobs and incomes and a declining unemployment rate, has kept the demand for ownership housing strong,” said Toronto Real Estate Board (TREB) President Bill Johnston.

The average selling price for February 2011 transactions was $454,423, which was more than five per cent higher than the average selling price reported in February 2010.

“Market conditions remain quite tight in the GTA. There is enough competition between

home buyers to promote continued price growth,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

Jonathan’s Opinion

If you recall in my January Market Watch Report, I stated the main reason that sales are down is not because the market is slowing down, but because there are fewer listings. This is still the case…there are not a lot of properties on the market to choose from. I also mentioned that ever since the announcement of the new mortgage rules, the amount of demand has increased because buyers want to purchase a home before these rules come into effect.

This trend is still alive and will continue until the end of March. Furthermore, take a look at sales vs price. Although sales are down, the average price is up. This is a strong indicator of a “topping” market. Please understand that I do not mean that the market will collapse after March or April, but I believe it will cool down. Listings will increase (as they always do in the spring), sales will fall as fewer buyers will rush in to purchase a home, and as a consequence, prices will remain stable (we will not see double digit percent increases as we have this last year and a half).

Therefore, if you want to sell your house fast, and for top dollar, you still have some time!!

Wednesday, March 2, 2011

Bank of Canada Announcement - Rates Remain Unchanged .

Would they or wouldn’t they? This was the question on many Canadian lips for the last couple of weeks. There has been much talk that a rise in interest rates in inevitable. That may be so—but not today. The Bank of Canada “is maintaining its target for the overnight rate at 1 per cent. The Bank Rate is correspondingly 1 1/4 per cent and the deposit rate is 3/4 per cent...

read the entire article at:

http://propertywire.ca/news/national-news/864-rates-remain-unchanged.html

read the entire article at:

http://propertywire.ca/news/national-news/864-rates-remain-unchanged.html

Tuesday, February 8, 2011

January Market Watch Report

January 2011

Good Start to 2011

TORONTO – February 4, 2011

Greater Toronto REALTORS® % reported 4,337 transactions through the Toronto MLS® system in January 2011. This result was 13 per cent lower than the record result reported in January 2010.

“While off the record pace experienced a year ago, the GTA resale market has started the year on a solid footing. Home buyers in Toronto and surrounding areas continue to benefit from a diversity of housing types for sale at many different price points,” said TREB President Bill Johnston.

The average selling price for January 2011 sales was $427,037, representing an increase

of over four per cent compared to the average of $409,058 reported in January 2010.

“The average selling price is expected to grow at a moderate pace in 2011. Growth rates in the three to five per cent range will be sustainable from an affordability perspective,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

Jonathan's Opinion

It is important to fully understand the figures above. The main reason that sales are down relative to last January is not because the market is slowing down, but because there are fewer listings. This means that there are not a lot of properties on the market to choose from. In addition, ever since the announcement of the new mortgage rules (see below), the amount of demand has increased because buyers want to purchase a home before these rules come into effect.

So what we have now is disequilibrium between sellers and buyers (supply/demand). There are more buyers (demand) then sellers (supply) in the market place, which leads to faster sales, less days on the market for listings, and potentially higher prices. In fact, we are starting to see a resurgence of bidding wars and multiple offers.

Although the numbers do not indicate what I’m mentioning, it is happening, and you will see that next month’s market watch report will have significantly different numbers. I am forecasting that after March the market will slow down somewhat (there will not be as much buying frenzy), but prices will not be affected. I believe prices will remain stable throughout all of 2011. In any case, if you are thinking of selling, now is the best time!!

Good Start to 2011

TORONTO – February 4, 2011

Greater Toronto REALTORS® % reported 4,337 transactions through the Toronto MLS® system in January 2011. This result was 13 per cent lower than the record result reported in January 2010.

“While off the record pace experienced a year ago, the GTA resale market has started the year on a solid footing. Home buyers in Toronto and surrounding areas continue to benefit from a diversity of housing types for sale at many different price points,” said TREB President Bill Johnston.

The average selling price for January 2011 sales was $427,037, representing an increase

of over four per cent compared to the average of $409,058 reported in January 2010.

“The average selling price is expected to grow at a moderate pace in 2011. Growth rates in the three to five per cent range will be sustainable from an affordability perspective,” said Jason Mercer, TREB’s Senior Manager of Market Analysis.

Jonathan's Opinion

It is important to fully understand the figures above. The main reason that sales are down relative to last January is not because the market is slowing down, but because there are fewer listings. This means that there are not a lot of properties on the market to choose from. In addition, ever since the announcement of the new mortgage rules (see below), the amount of demand has increased because buyers want to purchase a home before these rules come into effect.

So what we have now is disequilibrium between sellers and buyers (supply/demand). There are more buyers (demand) then sellers (supply) in the market place, which leads to faster sales, less days on the market for listings, and potentially higher prices. In fact, we are starting to see a resurgence of bidding wars and multiple offers.

Although the numbers do not indicate what I’m mentioning, it is happening, and you will see that next month’s market watch report will have significantly different numbers. I am forecasting that after March the market will slow down somewhat (there will not be as much buying frenzy), but prices will not be affected. I believe prices will remain stable throughout all of 2011. In any case, if you are thinking of selling, now is the best time!!

Tuesday, January 18, 2011

Change in Mortgage Rules

Ottawa, January 17, 2011

The new measures:

•Reduce the maximum amortization period to 30 years from 35 years for new government-backed insured mortgages with loan-to-value ratios of more than 80 per cent. This will significantly reduce the total interest payments Canadian families make on their mortgages, allow Canadian families to build up equity in their homes more quickly, and help Canadians pay off their mortgages before they retire.

•Lower the maximum amount Canadians can borrow in refinancing their mortgages to 85 per cent from 90 per cent of the value of their homes. This will promote saving through home ownership and limit the repackaging of consumer debt into mortgages guaranteed by taxpayers.

•Withdraw government insurance backing on lines of credit secured by homes, such as home equity lines of credit, or HELOCs. This will ensure that risks associated with consumer debt products used to borrow funds unrelated to house purchases are managed by the financial institutions and not borne by taxpayers.

Our Government’s ongoing monitoring and sound underlying supervisory regime, along with the traditionally cautious approach taken by Canadian financial institutions to mortgage lending, have allowed Canada to maintain strong and secure housing and mortgage markets.

The adjustments to the mortgage insurance guarantee framework will come into force on March 18, 2011. The withdrawal of government insurance backing on lines of credit secured by homes will come into force on April 18, 2011.

The new measures:

•Reduce the maximum amortization period to 30 years from 35 years for new government-backed insured mortgages with loan-to-value ratios of more than 80 per cent. This will significantly reduce the total interest payments Canadian families make on their mortgages, allow Canadian families to build up equity in their homes more quickly, and help Canadians pay off their mortgages before they retire.

•Lower the maximum amount Canadians can borrow in refinancing their mortgages to 85 per cent from 90 per cent of the value of their homes. This will promote saving through home ownership and limit the repackaging of consumer debt into mortgages guaranteed by taxpayers.

•Withdraw government insurance backing on lines of credit secured by homes, such as home equity lines of credit, or HELOCs. This will ensure that risks associated with consumer debt products used to borrow funds unrelated to house purchases are managed by the financial institutions and not borne by taxpayers.

Our Government’s ongoing monitoring and sound underlying supervisory regime, along with the traditionally cautious approach taken by Canadian financial institutions to mortgage lending, have allowed Canada to maintain strong and secure housing and mortgage markets.

The adjustments to the mortgage insurance guarantee framework will come into force on March 18, 2011. The withdrawal of government insurance backing on lines of credit secured by homes will come into force on April 18, 2011.

Wednesday, January 12, 2011

Caribbean Vacation

A winner has been chosen!!!

Please refer to the right side of this page, and click on "2010 Vacation Winner"

Please refer to the right side of this page, and click on "2010 Vacation Winner"

Subscribe to:

Posts (Atom)